Hong Kong Police Bust Triad Money Laundering Ring, Arrest 82 Including Leader of Sun Yee On

Hong Kong police have cracked down on the Sun Yee On triad with 82 arrests, freezing over HKD 1 billion and seizing luxury assets linked to massive money laundering.

@yingztoe3r7 ♬ 原聲 - 国际金融报 - 国际金融报

The Massive Sun Yee on Money Laundering Bust

In late July 2024, Hong Kong's authorities launched Operation Arrow, an unprecedented move targeting one of the city's largest criminal syndicates, the Sun Yee On triad. With a coordinated strike across multiple residences and business locations spanning Hong Kong Island, Kowloon, and the New Territories, the police dealt a crushing blow to the syndicate's illicit financial network.

The operation led to the arrest of 82 individuals, including the notorious leader of the triad, Chan Sik-lin (陈孝廉) (nicknamed "Siu B" 细B), alongside his family members and close associates. These suspects, ranging from 19 to 78 years old, face serious charges including money laundering and conspiracy to defraud.

Unraveling a Complex Web of Financial Crimes

One of the most striking revelations from the investigation was the triad leader's clever attempt to hide his financial activities. Despite owning vast assets, Chan Sik-lin was reported to have no personal bank accounts, income declarations, or tax payments. Instead, he orchestrated a complex scheme using family members and trusted individuals to manage and launder immense sums of money.

This network included ownership of properties valued at over HKD 100 million, luxury cars, and an array of high-end valuables such as watches, jewelry, and designer handbags. The police seized cash totaling around HKD 8.26 million and assets worth over HKD 7 million, including a staggering 1,100 bottles of fine wine and even a giant plush toy valued as a symbol of the extravagant lifestyle funded by crime.

Financial Trails and the Role of a Trust Company

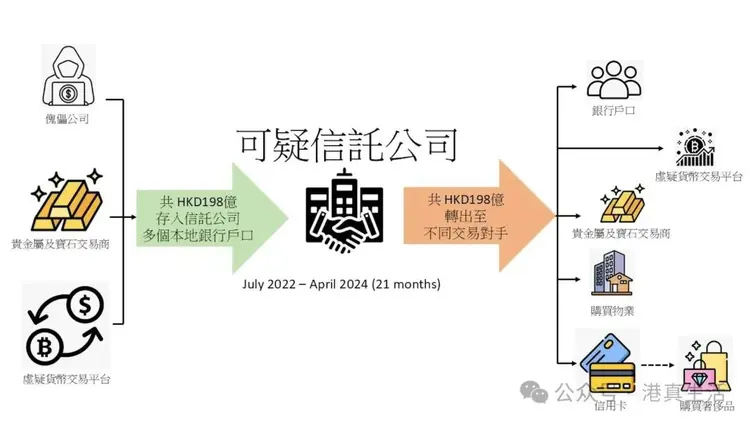

Authorities discovered that the triad had established a trust services company in 2021, which became a critical instrument for laundering funds. Over just 21 months—from 2022 to February 2024—the company processed deposits and withdrawals totaling approximately HKD 39.6 billion, suspected to be proceeds of crime.

Money was rapidly shifted to various nominee accounts, then converted into virtual assets or used for daily expenses and luxury purchases by the company's directors and associates. This fluid movement of funds highlights how organized crime groups adapt to financial regulations and technology to evade detection.

What This Means for Hong Kong and Beyond

This sweeping crackdown raises urgent questions about the vulnerability of financial systems and real estate markets to exploitation by criminal organizations. It also underscores the growing sophistication of money laundering methods which are increasingly entwined with legitimate business fronts.

Law enforcement agencies face the ongoing challenge of staying one step ahead in an environment where illicit gains are disguised through complicated trusts, virtual assets, and nominee structures. The Hong Kong Police Force's decisive action sends a clear message that organized crime will not go unchecked—but vigilance and innovation remain paramount to curbing such criminal enterprises.

As investigations continue, authorities do not rule out further arrests, reflecting the scale and depth of this criminal network. For residents and businesses in Hong Kong, this operation highlights the critical importance of transparency, regulation, and community cooperation in dismantling the financial underworld.

Final Thoughts

While the flashy luxury items and massive sums frozen grab headlines, this case serves as a sober reminder that the consequences of organized crime go far beyond material losses. They impact social stability, economic integrity, and public trust. Hong Kong's bold strike against the Sun Yee On triad is a pivotal step, but the fight against money laundering and organized crime is far from over.

🔍 Stay informed, stay vigilant.